Basic information:

| Corporate name: | Telefónica O2 Czech Republic, a.s. (Telefónica O2, the Company) |

| Registered address: | Praha 4, Za Brumlovkou 266/2, postal code 140 22 |

| Company identification number: | 60193336 |

| Taxpayer registration number: | CZ60193336 |

| Date of incorporation: | 16 December 1993 |

| Legally existing from: | 1 January 1994 |

| Duration of the company: | the company was founded for an indefinite period of time |

| Legal form: | joint-stock company |

Statute of law under which the issuer was incorporated: provisions of Section 171(1) and Section 172 (2) and (3) of the Commercial Code

Commercial court: Prague Municipal Court

Commercial court record number: Section B, File 2322

Bonds issued by Telefónica O2

Bond programme:

Maximum volume of unredeemed bonds: CZK 20,000,000,000

Programme duration: 2002–2012

Maturity of issues in the programme: maximum of 15 years.

As at 31 December 2009, no bond issue was made under the bond programme.

Trading in the shares of Telefónica O2 in 2009

| 2009 | 2008 | |

|---|---|---|

| Number of shares (in millions) | 322.1 | 322.1 |

| Net profit/(loss) per share (in CZK) 1 | 38.5 | 40.6 |

| Highest share price (in CZK) 2 | 500.0 | 563.5 |

| Lowest share price (in CZK) 2 | 359.8 | 336.0 |

| Share price at the end of period (in CZK) 2 | 418.0 | 424.1 |

| Market capitalization (in CZK billions) 2 | 134.6 | 136.6 |

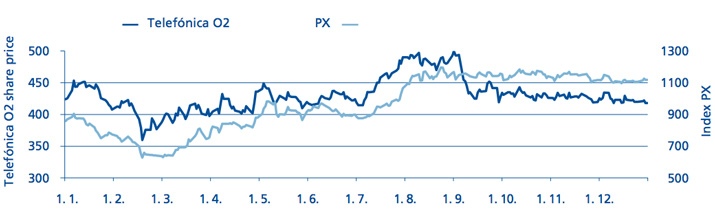

In 2009, Telefónica O2 once again ranked among the most important companies on the Czech capital markets according to market capitalization and trading volumes. The total volume of trades in company shares on the main stock market of the Prague Stock Exchange (PSE) in 2009 was CZK 65.7 billion compared to CZK 91.1 billion in 2008. Trading in Telefónica O2 Czech Republic shares, as measured by the total volume of shares traded, made up 14.2% of all trades on the PSE stock market. Telefónica O2 shares were the second most traded issue on the PSE in 2009, after ČEZ shares. The average daily volume of trades in company shares in 2009 was CZK 258 million.

As at 30 December 2009 (the last trading day on the PSE in 2009), the market capitalization reached CZK 134.6 billion, ranking Telefónica O2 fourth on the PSE stock market. The share price of Telefónica O2 on the last PSE trading day in 2009 reached CZK 418, which was a decline of 1.44% on the year previous. The share price reached its maximum of CZK 500 on 1 September 2009, and its minimum of CZK 359.8 on 18 February 2009. The average share price in 2009 was CZK 430.6, compared to CZK 475 in 2008.

The above-average dividend yield, aided by the high free cash flow generation and a low level of debt, still make the shares of Telefónica O2 very attractive to investors.

Trading in Telefónica O2 shares projected over the PX index in 2009

Dividends

At the Ordinary General Meeting of 27 April 2007 held in Prague, the shareholders approved a dividend payment from the 2006 net profit and part of the retained earnings from previous years, in the total amount of CZK 16.104 billion, i.e. CZK 50 per share of nominal value of CZK 100 and CZK 500 per share of nominal value CZK 1,000, before tax. The record day for the payment of dividends was 10 September 2007 and the disbursement date 3 October 2007.

At the Ordinary General Meeting of 21 April 2008 held in Prague, the shareholders approved a dividend payment from a part of the 2007 net profit and a part of the reserve fund which the Company can use at its discretion, in the total amount of CZK 16.104 billion, i.e. CZK 50 per share of nominal value of CZK 100 and CZK 500 per share of nominal value of CZK 1,000, before tax. The record day for the payment of dividends was 17 September 2008 and the disbursement date 8 October 2008.

At the Ordinary General Meeting of 3 April 2009 in Prague, the shareholders approved a dividend payment from a part of the 2008 net profit and part of the retained earnings from previous years in the total amount of CZK 16.104 billion, i.e. CZK 50 per share of nominal value of CZK 100 and CZK 500 per share of nominal value of CZK 1,000, before tax. The record day for the payment of dividends was 9 September 2009 and the disbursement date 7 October 2009.

Dividend policy

The Company does not have an official long-term dividend policy at present. The Company has indicated several times that it did not intend to retain surplus cash. In the following periods, the Board of Directors will make annual proposals for the payment of dividend, based on a diligent analysis of the current and future performance of the Company, including the projected future cash flows and investments, development costs and acquisitions. This approach is in line with the investment strategy of directing investment into pro-growth areas, such as broadband internet access, IPTV, mobile services, business and ICT solutions for the government and the corporate segment and the development of the mobile operation in Slovakia.

Details of patents or licenses, industrial, commercial or financial contracts which have a significant bearing on the business:

1) Patents and licences

Telefónica O2 has licence agreements for the following software products: application middleware (BEA), database environment (Oracle), operating systems (Hewlett-Packard, SUN and Microsoft), workstation software (Microsoft), CRM using Siebel SW (Oracle), customer care and billing software (Amdocs and LHS) and enterprise resource planning software ERP (SAP).

2) Industrial and commercial contracts

Telefónica O2 maintains a diverse portfolio of technology suppliers. The main objective of the Company with respect to the contracted suppliers is to have competition on the supply side. All principal technology supply contracts are awarded by tender.

In 2009, the main suppliers of technology and related services to the Company were IBM Česká republika, Alcatel Czech, AutoCont CZ, Vegacom, Siemens, Accenture Central Europe B.V., Indra, DNS, NextiraOne Czech, Amdocs Development Limited, LHS, Hewlett-Packard and Huawei Technologies Co.

3) Financial contracts

Financial obligations as at 31 December 2009 divided into short-term and long-term (in CZK million):

| Short-term (maturing within a year) | 87 |

| Long-term | 3,044 |

| Total | 3,131 |

|---|

Loans, bonds issued and other financial obligations:

| Currency | Outstanding in the currency as at 31 December 2009 | Outstanding in CZK as at 31 December 2009 | Redemption | |

|---|---|---|---|---|

| Private Placement – debt instrument | EUR | 115,040,673 | 3,044,551 | 2012 |

| Other financial obligations | 87,309 |

EUR/CZK exchange used in the table for conversion purposes (as at 31 December 2009) is CZK 26.465/EUR.

The above loan and the other financial obligations were repaid in accordance with the relevant loan agreements or the Terms and Conditions of Issue. As at 31 December 2009, Telefónica O2 had no overdue loan obligations.

Investments

Main investments made by Telefónica O2 in the last two accounting periods (in CZK million):

| 2009 | 2008 | |

|---|---|---|

| Network & Operations | 2,976 | 3,661 |

| Customer Solutions | 707 | 694 |

| IT & Products | 1,206 | 1,838 |

| Property & Logistics | 219 | 302 |

| Brand stores | 17 | 53 |

| Subsidiary companies and other investments * | 527 | 41 |

| Projects of the Telefónica Group | 187 | – |

| Investments related to Telefónica O2 Slovakia made in the Czech Republic | 39 | 197 |

| Telefónica O2 Slovakia | 611 | 1,302 |

| Total | 6,489 | 8,088 |

* Including additional internal work – capitalized

All principal investments were made in the Czech Republic and in Slovakia, and were financed from own capital and from borrowings.

In 2009, the Company continued to implement an adequate investment policy, which clearly favours the development and support of progressive, customer-oriented technologies that have a growth potential for the future, and emphasises the internal integration and efficiency improvements in the Company.

The structure of investment expenditure reflected the existing customer demands for new trends in telecommunications services with a high standard and quality of execution, and the efforts to complete the integration processes for the delivery of convergent services, aimed at the strengthening of the primacy of the converged operator.

The mobile segment was dominated mainly by investments in the UMTS technology (up 73% on the previous year); the coverage of the population reached 26.6% at the end of 2009. Investments in the 3G area were accompanied by modifications in the existing 2G network (2G swap) and the roll-out of the Mobile Broadband concept (3G + EDGE). In the fixed access segment, investments went mainly into boosting the speed, availability and quality of ADSL, IPTV, Voice over IP and value added services.

In terms of business solutions, the volume of investment in this area increased by approximately 2%; in this respect, data connectivity projects played an important role. In this segment, increased effort was directed towards improving the quality of the service portfolio and customer experience, especially with regard to the leadership in the convergent services market. The flagship project in the segment of business solutions for the government in 2009 was the implementation of the data box system.

In 2009, Telefónica O2 also participated in projects implemented on the level of the global Telefónica Group, which were aimed at improving the hosting capacities of business solutions.

The convergent process integration was represented mainly by investments in information systems, in which the common denominator was to achieve greater customer satisfaction and open doors to new products and services (CRM systems). Investment in the new integrated ERP system (SAP) has helped to achieve a higher rate of internal efficiency in the Company.

In Slovakia, efforts were directed mainly at the construction of the proprietary network, improving the quality of the CRM system and e-applications. Investments in the GSM network were carried out as per the licence and system development requirements. By the end of 2010 Telefónica O2 Slovakia put 917 BTS in operation, of which 70 were commissioned during 2009 (302 in 2008). The network of Telefónica O2 Slovakia covered almost 93% of the population, which is approximately twice of what the terms of the licence require.

Principal future investments

In the period 2010-2011, the Company will continue to implement the standard investment policy for the telecommunications sector, which favours performance increases and the implementation of progressive technologies and customer approaches, aimed at achieving the Company’s overall general strategy and increasing the market share in the Slovak telecommunications market.

A key project in the Czech Republic is the country-wide deployment of the Mobile Broadband technology, which will lay foundations for future considerable improvements in the quality, efficiency and coverage of telecommunications and data services.

General Meeting

The Ordinary General Meeting of Telefónica O2 will be held on 7 May 2010 in Prague.

Financial calendar

Date of release of the running financial results

| For the first quarter of 2010 | 12 May 2010 * |

| For the first half of 2010 | 28 July 2010 * |

| For three quarters of 2010 | 10 November 2010 * |

| For the year 2010 | 28 February 2011 at the latest instance |

* tentative date

Institutional investors and shareholders please contact

Investor Relations

| Tel.: | +420 271 462 076, +420 271 462 169 |

| Fax: | +420 271 463 566 |

| E-mail: | investor.relations@o2.com |

| URL: | http://www.cz.o2.com/osobni/cz/o_nas/investor_relations/index.html |

| Address: |

Telefónica O2 Czech Republic, a.s. Za Brumlovkou 266/2 140 22 Praha 4 |